Top stories

More news

Worldwide, padel is having its moment with estimates of 25 million players across 90 countries. South Africans have been quick to take up the sport since its emergence here in 2020 and BrandMapp, an independent annual survey canvassing over 33,000 adults living in households with a R10,000 or more monthly income, records that about 1% of the taxpaying class are currently padel players, putting it on par with horse-riding, surfing and motorsports.

“With more and more courts being developed in up-market neighbourhoods, at gyms and on the rooftops of shopping malls, there’s little doubt that padel is ‘a thing’ for affluent South Africans,” says Brandon de Kock, BrandMapp’s director of storytelling. “According to the leading booking platform for the activity, there are around 100,000 active padel players right now, which correlates quite closely with our data. We’re seeing the rapid development of leagues and tournaments, and local star players are emerging. Celebrities and brands are eager to associate themselves with padel. The big question is whether the sport is going to become another elite pastime in South Africa, like golf or mountain-biking, or if padel develops along lines that are inclusive and accessible, embedding the sport in the broad and diverse South African culture over the long term. That’s going to be determined by the vision and intentions for the sport in the country, which at the moment is in the hands of corporate developers and other businesses in the game.”

Spain is the world’s dominant padel nation with more than 5 million players, 14,000 courts and the World Padel Tour platform. The country’s first courts were built in 1974, after a Spanish prince reportedly visited the Mexican padel inventor and loved the game. There have been decades for padel to embed itself in Spanish culture, becoming the second most popular sport after football. It’s a model of sport development that has optimised on the relatively low costs of playing padel and the opportunities to make the sport accessible to all.

De Kock says: “Over the years, the Spanish government has been a major player in padel development, building community courts at the local level and integrating padel in public sports programmes to achieve widespread demographic reach. It’s an extraordinary success story and today, Spain reaps the social, economic and sports tourism benefits of padel as an integral aspect of modern Spanish life and culture.”

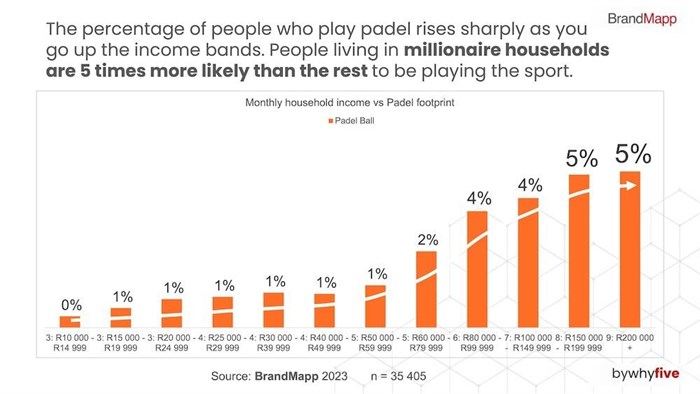

In South Africa, padel started out and gained momentum in middle class enclaves. The very first courts were built for private use at Val De Vie, a wealthy gated community in the Paarl Winelands. Elite country clubs in the Western Cape and Gauteng were also amongst the early pioneers of South African padel, converting under-utilised bowling greens and tennis courts in the leafy suburbs into padel courts. And while the sport’s footprint has spread out somewhat from the major cities, it clearly remains an elite activity. According to the latest BrandMapp survey, South African padel players are split equally male/female, almost 60% are in the 35- to 65-year-old bracket and about 80% of the country’s padel players are living in Gauteng and the Western Cape. But perhaps most notably, about 50% of padel players are TopEnders, which means they are members of the exclusive group of 3 million South Africans (just 5% of the population) living in households earning more than R40K per month.

De Kock says: “It’s not surprising that when we look at the income breakdown of South African padel players, BrandMapp finds the majority of them sitting in the upper middle-class and higher. There are well-organised padel courts and clubs in the middle of their neighbourhoods, and they have the luxury of time to play the game three times a week. So, padel is currently in the category of sports that have a significantly higher footprint as you go up the income ladder. It still has a way to go to catch golf as a millionaire’s pastime, but for top income earners, padel is almost as popular as mountain biking.”

In contrast to those elite activities, where the costs of taking part in the sport are prohibitive to most, padel expenses are relatively modest. The game is typically played by four people, and the cost of an hour’s play ranges from R400 to R600 a game. Shared amongst the players, this is R100 to R125 per individual. Padel racquets range from R1,000 to R10,000, but at most facilities you can hire one for a fee of around R50 per game. The Playtomic App offers discounts on all bookings through the platform, and padel club owners and padel networks such as Virgin Active and Discovery Vitality offer similar, regular incentives. Do the maths and it could be argued that playing a game of padel in South Africa is about as much of an investment as a movie ticket.

So, if the costs of playing padel are not exclusive to top earners in South Africa, why is it struggling to break out of the ‘country club’ and into the mainstream? De Kock says: “Well, simple geography is certainly at play here. As a profit-driven investment, the people putting up the padel courts are clearly targeting high-income areas. We can only wait and see if that changes, and whether visionary padel entrepreneurs emerge who see the full potential of the sport and start developing facilities for more middle- and lower-income communities. Maybe we could learn a thing or two from Spain!”

In countries like Spain, but also padel-developing nations like Italy, Sweden, the UK and Argentina, there is government recognition for padel as a culturally significant sport that promotes health, active lifestyles, social engagement and cohesion. At the local government level there is support and even investment in padel infrastructure that is intentionally making the sport accessible in low-income communities.

What is it about the sport that explains its rapid rise in popularity? “Padel may look a bit simple to anyone who’s grown up with traditional racquet sports,” De Kock explains, “but it has a few key attributes that underpin its almost ‘viral’ appeal. It’s fun, it’s sociable and if you’re committed to healthy and active lifestyles, you’re likely to be attracted to padel. But above all, unlike tennis and squash, where you can’t have a good game if the players aren’t of a similar skill level, padel is much easier to enjoy as a mixed-skill-level sport. It’s also easy to learn how to play, unlike golf, for example, so it has fantastic potential to be inclusive – you can have a great game with your kids, with older people and with any gender mix. But if you want to take things up a competitive notch or two, you certainly can. The bottom line is, South Africa could be an ideal padel-playing nation with our widespread enjoyment of sports and fantastic all-year-round weather. But many have come before and failed to go mainstream. It remains to be seen whether padel peaks as an elite craze or becomes a part of broader South African culture.”

BrandMapp 2023 insights are now available directly from the BrandMapp team at WhyFive Insights and by subscription via Telmar, Softcopy, Nielsen and Eighty20. For data access email az.oc.evifyhw@enna-eiluJ.

Visit www.Whyfive.co.za for an overview of what’s in the new data.