In the huge landscape of global economy, the wine industry emerges as a prominent player, not only for its cultural and gastronomic value but also for its significant economic impact on multiple countries.

In this context, South Africa stands out as a notable example, distinguishing itself on the world stage for the quality and quantity of its wine production.

Despite the inherent fluctuations in any economic sector, this industry has sought to remain stable. In fact, personal loans have often financed investments in this sector, which, while facing challenges, has shown impressive resilience.

In 2022, for example, the United Kingdom showed notable interest in South African wine despite its price increase, maintaining its position as the primary export market for South Africa. It even challenged the global trend by increasing its acquisitions by 8% compared to the previous year, especially driven by higher-value bulk exports.

Nonetheless, in China the situation was less promising. This market, which had previously shown robust growth for South African wine, experienced a significant slowdown due to lockdowns caused because of Covid. This resulted in a 38% drop in total volume and a 26% decline in terms of value.

Similarly, Germany, the second-largest export market for South African wine, also faced a significant decline, with a 9% drop in export volume and a 17% decrease in value. According to Wines of South Africa, this situation could be related to the reduction in tourism to South Africa in recent years.

Image supplied

In addition to the mentioned factors, Wines of South Africa pointed out that the overall decrease in global exports was attributed to maritime transport issues at the Cape Town port. These challenges were caused by adverse weather conditions preventing ships from docking, as well as a two-week strike by port workers.

"The recovery of exports was hindered in 2022 by several factors beyond the control of our producers (...) The months of April and October were directly affected by weather conditions and the strike at the Cape Town port. Additionally, a shortage of shipping containers and packaging materials posed additional challenges," commented Siobhan Thompson, CEO of Wines of South Africa.

In this regard, although the wine industry is still recovering from the impacts of the Covid-19 pandemic, and some challenges are expected to persist in the future, South Africa Wine considers that conditions will gradually improve.

During a presentation of sector outlook conducted by the Bureau for Food and Agricultural Policy (BFAP), Rico Basson, CEO of SA Wine, emphasised the importance of the current moment for the local wine and brandy industry.

In his speech, he highlighted the need to unlock greater value through offering suitable products, involving long-term business partners, attracting investments, prioritizing better prices for both bottled and bulk wine, and continuously strengthening premiumization.

Gary Pickering and Kerrie Pickering 4 Jan 2024 Global disruptions

Additionally, he shared his projections for the sector between 2023 and 2032, revealing various global challenges ranging from high inflation and the energy crisis caused by the war in Ukraine to persistent supply chain disruptions. Local factors such as load shedding, high input costs, limited government support, and inefficient logistics also contribute to these challenges.

It also must be considered that according to the OIV report titled "State of the World Vitivinicultural Sector in 2022", the wine production in South Africa was 10.2 million hectoliters in that year, reflecting a 6% decrease compared to 2021.

Even so, it was highlighted that the production in 2022 returned to the average levels recorded before the onset of the drought that heavily affected the sector from 2015, persisting for several consecutive years.

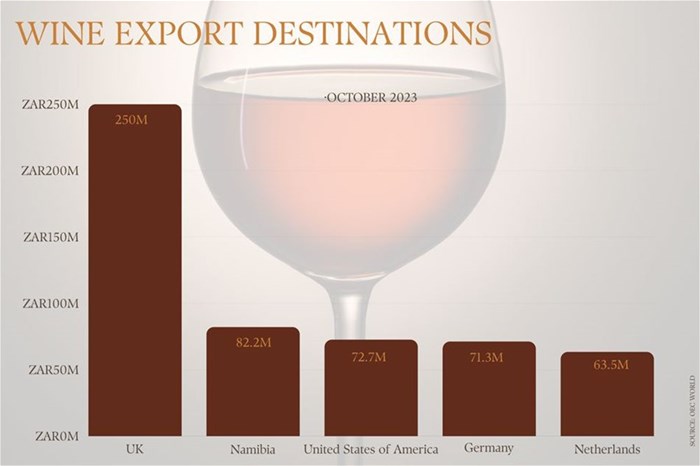

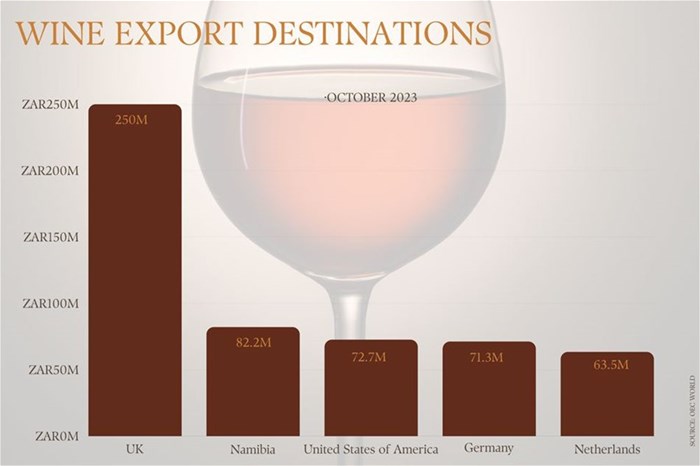

But what was the scenario in 2023? In October of last year, South Africa recorded wine exports valued at R1.08bn, while imports reached R106m, resulting in a positive trade balance of R974m.

From October 2022 to October 2023, South African wine exports experienced an increase of R342m, it means a growth of 46.4%, going from R738m to R1.08bn. Meanwhile, imports decreased by R35.9m, equivalent to a 25.3% reduction, going from R142m to R106m.

About export destinations, the United Kingdom is still at the top of the list with R250m, followed by Namibia (R82.2m), the United States (R72.7m), Germany (R71.3m), and the Netherlands (R63.5m). On the other hand, concerning imports, the main source countries were France (R88.6m), Italy (R9.36m), Portugal (R6.51m), Spain (R790,000), and Argentina (R476,000).

Image supplied

The significant increase in wine exports compared to the previous year was mainly due to a substantial rise in exports to the United Kingdom by 90.4%, the United States by 48.1%, and Italy with a 1.36% increase.

In contrast, year-on-year imports experienced a decrease, primarily due to reduced transactions from Israel (-99.6%), Chile (-99.9%), and the United Kingdom (-99.2%).

As South Africa continues to consolidate its position on the international wine stage, it is evident that its wine industry is not only important locally but also plays a crucial role in the global economy.

Similarly, its ability to stand firm against economic fluctuations and external challenges shows its resilience and commitment to the excellence of this product.