Related

Top stories

More news

ESG & Sustainability

Redisa calls on govt to fix South Africa’s “broken” waste management system

The latest data from ooba Home Loans, South Africa’s leading home-loan comparison service, indicates early signs of a tentative recovery among first-time homebuyers— the prized market segment that boosted home-loan activity (and house prices) during the Covid-19 pandemic when interest rates hit a multi-decade low of 7%.

And with another interest-rate cut on the cards in November, Rhys Dyer, chief executive officer of ooba Group believes that first-time homebuyers will start to lead the recovery of the property market, supported by the banks.

“The ongoing stability of the country’s power supply coupled with the positive sentiment and stability around the formation of the GNU (Government of National Unity) as well as the lower levels of inflation have paved the way to a positive economic outlook, renewed investor sentiment, and the first interest-rate cut in four years,” he comments.

Other trends emerging for Q3 ’24 showcase the resilience of both homebuyers and lenders in the "higher for longer" interest-rate environment as well as an uptick in self-employed applicants, steady bank approval rates, lower deposit requirements, higher average bond sizes and the ongoing offer of attractive rate concessions - evidence of how vested the banks are in assisting South Africans achieve their homeownership goals.

Supported by the banks, younger first-time homebuyers are spending more

First-time homebuyers, now one year younger than in Q3 ’23 at age 35, accounted for 51% of ooba Home Loans' applications in September 2024, reflecting a swift response to expectations of reduced interest rates. However, Dyer notes that over the quarter, the group represented 48% of applications indicating there is still some ground to cover before surpassing the 50% mark for the first time since Q4 '21.

He does however share that first-time homebuyers have shown resilience, with an average purchase price of R1,155,056 in Q3 ‘24 – up by 3.4% in Q3 ’23 and 0.4% in Q2 ’24.

Regionally, in terms of average purchase price, the Western Cape yielded the highest average purchase price paid by the segment from January to September 2024 – at R1.57m. “On the other hand, the Free State and more recently, Gauteng South & East, are the only regions where first-time homebuyers are purchasing for under R1m on average, making them the most affordable regions for this segment.”

While purchase prices are trending higher, deposits have recorded a slight decrease. “This quarter’s deposit data cites a reduction in deposit size for first-time homebuyers, down by -2.9% year-on-year – now at R114,161 (9.9% of the average home loan),” says Dyer.

“As affordability improves with lower interest rates, this trend is likely to continue, enabling more homebuyers to qualify for 100% bonds and further decreasing the average deposit amount.”

When it comes to loan to value (LTV) ratios, Dyer indicates that the average first-time homebuyer LTV ratio in the Western Cape sits at a generous 96.4% compared to that of the national average (89.9%). “This figure illustrates lower deposit requirements for first-time homebuyers in the region,” he says.

“And while zero-deposit bond applications have tapered off from a high of 67.5% in June 2020 to 54.7% at present, we do anticipate that this trend will reverse. Lower interest rates will entice first-time homebuying activity and we expect that young homebuyers will be eager to enter the housing market without necessarily having a deposit."

First-time homebuyers in the Western Cape are South Africa's youngest homebuyers

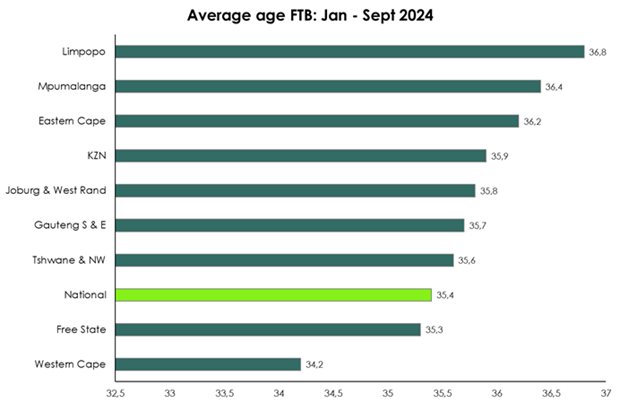

Looking to the age breakdown of first-time homebuyers per region, Dyer explains: “Limpopo is home to the oldest average first-time homebuyer (aged 36.8) while the Western Cape is home to the youngest average first-time homebuyer (aged 34.2) (despite Western Cape’s property prices outpacing all other regions)."

Pre-qualified first-time homebuyers enjoy high bank-approval rates

In their forward planning strategy, first-time homebuyers have capitalised on the clear benefits of being pre-qualified for a home loan. “The higher approval rate of first-time buyers that have been pre-qualified by ooba Home Loans illustrates the importance of pre-qualification,” adds Dyer, pointing to the average approval rate for pre-qualified buyers which now stands at 90.5% (Q3 ’24), in contrast to those not pre-qualified (at 74.5%).

General homebuyer activity and house-price growth depicts early signs of recovery

General homebuyer trends and behaviours support a more positive sentiment in light of current market developments. “The average property purchase price has increased nominally by 1.7% year-on-year, from R1,423,663 in Q3 ’23 to R1,447,845 in Q3 ’24. In addition, the average approved bond size saw a significant year-on-year improvement, climbing 6.3% from R1,285,772 in Q3 ’23 up to R1,366,215 in Q3 ’24.”

Regionally, in contrast to the Western Cape with an average purchase price of R1.93m, the Free State, Gauteng South & East and KwaZulu Natal are among the lowest average purchase prices, making them ideal areas for homebuyers seeking affordable investment opportunities.

"Year-to-date national house prices have risen nominally, but the average growth in house prices varies sharply across regions, ranging from a high of +7.7% in the Western Cape to a low of -3.8% in Jo’Burg North & West Rand,” says Dyer.

Recent data by StatsSA revealed that the primary engine behind the current national housing-market recovery is the Western Cape. “Nonetheless, all major regional housing markets are showing signs of recovery. Johannesburg, where prices continue to decline from year-earlier levels, is starting to show signs of recovery and looks set to return to positive territory during the final quarter of 2024.”

Self-employed homebuyer applicants rise, with higher value properties

Q3 ’24 data also reveals increased buying activity by self-employed applicants, now accounting for 13.5% of the applications compared to 12% in Q3 ’23.

“While business owners were known to take a more cautious approach in a tough economic climate, our latest data shows a positive sentiment and the start of what could be a developing trend,” says Dyer. “Banks are also responding to this market by easing the terms and conditions of lending to this market in cases where business owners are professionals drawing a regular income.”

Also pertinent is that the self-employed buyer segment is investing in more expensive properties than their salaried counterparts. “The value of self-employed applicants’ home loan applications in Q3 ’24 was 21% of the total value of applications received, compared to just 19% in Q3 ’23.”

Competition among the country’s major banks remain elevated

“The banks continue to exhibit robust lending appetites,” adds Dyer. “In Q3 ’24, the average deposit size declined, signaling that banks are continuing to compete for home loans with lower deposit requirements. Additionally, our multiple bank-approval rates remain relatively steady at 82.8% (marginally down by just 0.5% in Q3 ’24).”

Attractive discounts to the prime lending rate also points to the high level of competition that continues to prevail among South Africa’s major banks. "We achieved an average weighted rate of concession in Q3 '24 of 0.55% for our home-loan applicants - 11 basis points less expensive than Q3 ’23.

“Savings like these, coupled with lowered interest rates, will lead to improved affordability across all categories in the months to come.”

Western Cape continues to lead in buy-to-let investment

Ooba Home Loans' latest data show demand for buy-to-let property investment in Q3 '24 at 12.2% of applications received, up by 0.3% from Q2 '24.

“Regionally, the Western Cape accounts for the lion’s share of demand with 31.1% of total applications, followed by the Eastern Cape (14.9%). We do however anticipate that as rates drop and the market accelerates, more investors will seek opportunities in the buy-to-let market segment.”

Looking ahead, Dyer is upbeat about the recovery of the property market and what Q4 ’24 holds in store. “The early signs of a positive response to the first-interest rate cut could be indicative of what’s to come,” he says.

“As a result of this, coupled with several petrol-price cuts and improved consumer confidence, we are seeing renewed interest in residential property, and we hope that this will soon accelerate.

"These factors, together with competitive lending by the banks, made possible by shopping around for the best possible deal on a home loan, could go a long way in driving stronger demand for homes in Q4 ’24 and into the New Year” he concludes.