In a

recent statement, Glencore’s CEO, Gary Nagle, revealed that the company’s production for 2023 was in line with their revised guidance. This was due to stronger volumes in the second half of the year across key commodities, including copper, zinc, nickel, and coal. Nagle also revealed that they expect to report a FY 2023 Marketing Adjusted EBIT result of approximately $3.5bn.

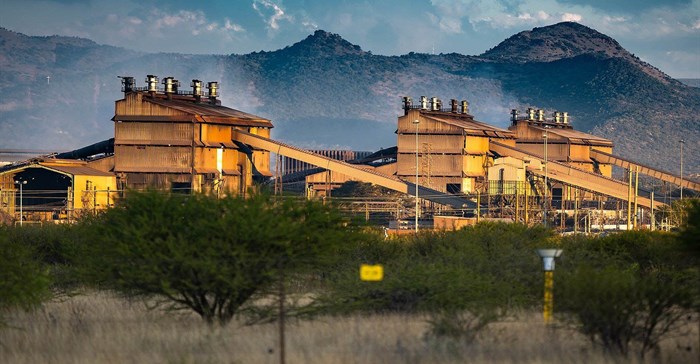

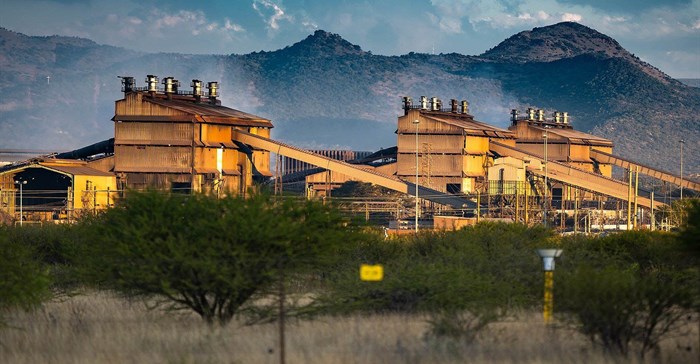

Glencore had a strong H2 performance in 2023.

However, compared to 2022, there was a moderate decrease in copper and zinc volumes. This was primarily due to the disposals of the Cobar copper mine and various South American zinc operations. Nickel volumes also fell by 9% due to higher third-party production at INO and maintenance at Murrin Murrin.

Despite various capacity constraints, coal production saw a 3% increase.

Looking ahead to 2024, Nagle provided updated guidance:

Copper is expected to be in the 950-1,010kt range, reflecting the sale of Cobar and cobalt market-related adjustments to operating rates at Mutanda.

Zinc guidance is positioned within a similar range at 900-950kt, while nickel production guidance is 80-90kt, excluding Koniambo.

Coal production is forecast to be steady at the guidance range mid-point of 110Mt, excluding any incremental volumes from the recently announced acquisition of a 77% interest in Teck’s steelmaking coal business.

Highlights

Own sourced copper production was 5% lower than 2022, primarily due to the sale of Cobar and lower copper by-product production, while cobalt production was 6% lower than 2022 - mainly due to feed plan adjustments at Mutanda.

Own sourced zinc production was 2% lower than 2022, mainly due to the 2022 disposals of South American zinc operations and the closure of Matagami, and nickel production was 9% lower than 2022 - primarily due to higher INO third party production and a planned shutdown of Murrin Murrin.