Anglo American may consider deeper cost-cutting measures unless market conditions improve after a fall in prices and a downturn in the platinum group metals (PGMs) sector that is the worst in 35 years, CEO Duncan Wanblad said on Monday. The diversified miner announced sweeping cuts last year to save about $1.8bn.

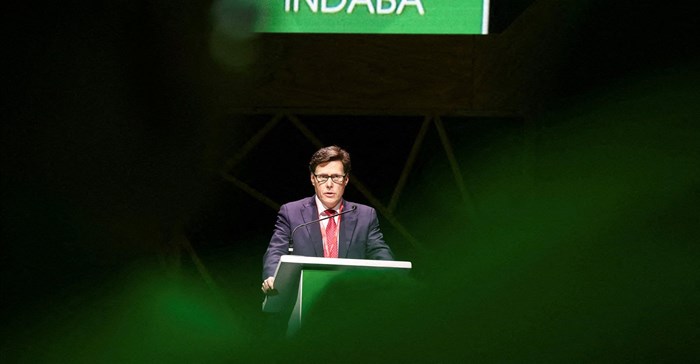

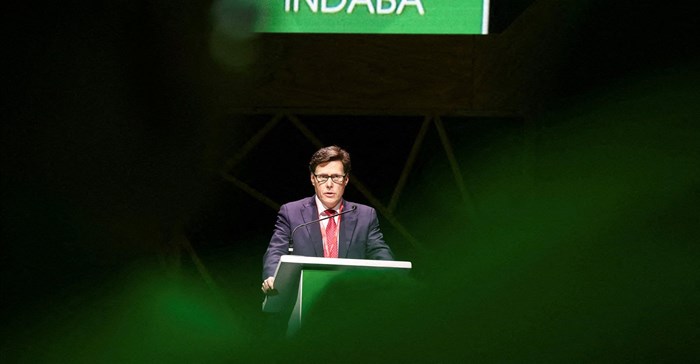

Anglo American CEO Duncan Wanblad speaks during the Investing in African Mining Indaba 2023 conference in Cape Town. Source: Reuters/Shelley Christians

Speaking on the sidelines of the African Mining Indaba in Cape Town, Wanblad said he did not see signs of any early PGM recovery, although diamond prices showed faint signs of strengthening.

"To the extent that market conditions continue, we will have to cut deeper and we will just knuckle down and get it done," Wanblad said. "I absolutely understand how difficult this is."

A drop in palladium and rhodium prices has squeezed profits for Anglo's South African units. At its iron ore unit in South Africa, a lack of sufficient rail capacity to ship material to port has also weighed.

Dorcas Nhlapo 19 Jan 2024 South African platinum miners have depended on automakers' use of PGMs to curb exhaust emissions from conventional cars and trucks and face uncertain demand as the world pivots towards electric vehicles.

Job cuts imminent

The country's Mineral Council said on Monday restructuring across the PGM sector could result in between 4,000 and 7,000 job cuts.

Wanblad declined to say how many jobs Anglo American plans to cut at its South African mines, but said it was "very probable" jobs would be affected.

The miner is also scouting for new copper opportunities in African countries, including the Democratic Republic of Congo, the CEO said. Anglo is searching for assets that comply with investors' environmental, social and governance (ESG) considerations, Wanblad said, while declining to say whether the company is currently in any talks.

DRC, the world's top cobalt supplier, and No. 3 copper producer, has "some fabulous rocks", the CEO said.

"We certainly have looked in the DRC and we will continue to look in the DRC," Wanblad said. "There's some great prospects there potentially. But ... it has to work in the first instance, economically and in the second instance, ethically."