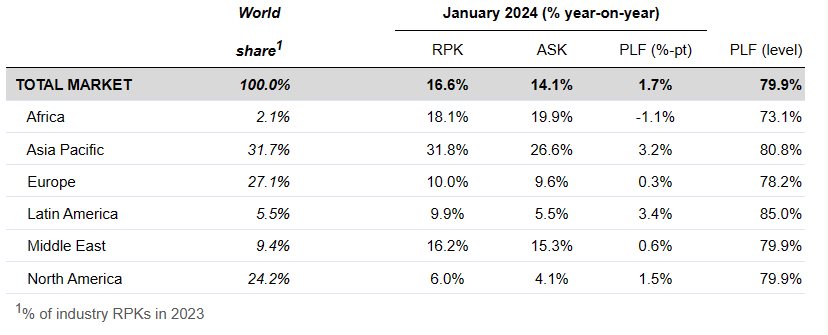

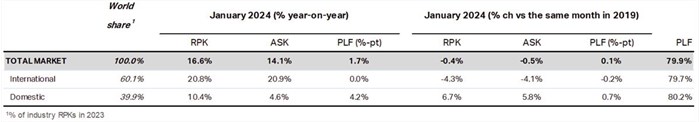

Data on global passenger demand for January 2024 have been released by the International Air Transport Association (Iata), indicating a strong start to the year. There was an increase of 16.6% in the overall demand, measured by revenue passenger kilometres (RPKs); a rise of 14.1% in available seat capacity (ASK) and a load factor of 79.9%. International demand increased by 20.8%, capacity increased by 19.9% and the load factor was maintained at 79.7%. The demand at home increased by 10.4%, capacity increased by 4.6% and the load ratio rose to 80.2%.

“2024 is off to a strong start despite economic and geopolitical uncertainties. As governments look to build prosperity in their economies in the busiest election year ever, it is critical that they see aviation as a catalyst for growth. Increased taxes and onerous regulations are a counterweight to prosperity. We will be looking to governments for policies that help aviation to reduce costs, improve efficiency and make progress towards net zero CO2 emissions by 2050,” said Willie Walsh, IATA’s Director General.

Regional breakdown: International passenger markets

African airlines saw a 18.5% traffic increase in January 2024 versus a year ago. January capacity was up 19.2% causing load factor to decline 0.4 percentage points to 73.3%, the lowest among the regions.

Asia-Pacific airlines saw an 45.4% increase in January 2024 traffic compared to January 2023, continuing the region’s rapid recovery after the lifting of pandemic restrictions. Capacity climbed 48.1% and the load factor fell by 1.5 percentage points to 82.6%. The exceptionally strong growth rate is largely attributable to China which was in the early stages of lifting COVID-19 travel restrictions in January 2023. The recovery in major international routes to/from Asia-Pacific is still lagging, but routes such as Asia-Middle East have exceeded pre-pandemic levels.

European carriers’ January 2024 traffic rose 10.8% versus January 2023. Capacity increased 10.7%, and the load factor edged up 0.1 percentage points to 77.3%. Routes between Europe and North America have rebounded particularly strongly from the pandemic and stand 6.5% higher than in January 2020.

Middle Eastern airlines posted a 16.2% rise in January 2024 traffic compared to a year ago. Capacity rose 15.7% and load factor climbed 0.4 percentage points to 79.9%.

North American carriers had a 12.3% traffic rise in January 2024 versus the 2023 period. Capacity also increased 13.7%, and load factor fell 1.0 percentage point to 79.4%.

Latin American airlines’ traffic rose 17.9% compared to the same month in 2023. January capacity climbed 13.2%, pushing the load factor up 3.4 percentage points to 86%, the highest among the regions.

Domestic markets

Domestic demand growth continues to be led by China, which saw strong demand for Lunar New Year travel. This is likely to have boosted traffic in February also. Chinese carriers have responded by increasing capacity, particularly by deploying wide-body jets.