These banks include BMCE Bank, ING Bank, Nedbank, Piraeus Bank, Société Générale, SEB, Standard Bank, Triodos Bank, Westpac and YES Bank.

The transition to a green, inclusive economy requires considerable finance. Research by an American non-governmental organisation, CERES, estimates that a 'clean trillion' dollars of additional investment is needed annually up to 2030 to enable new infrastructure to be made green. At the same time, Trucost puts the annual cost in natural capital degradation and negative environment externalities at $7.3 trillion a year.

Significant efforts are already under way to promote and enable the financial sector's participation in funding the transition to green economy. A report by UNEP's Inquiry into the Design of a Sustainable Financial System highlights policy makers' and regulators' steps to integrate sustainable development considerations into financial systems to make them fit for the 21st century.

Yet, despite these efforts, the availability of private finance for clean, inclusive investments remains limited. Indeed, a persisting core obstacle to shifting to a greener and inclusive development pathway is the elusiveness of the commercial viability and 'bankability' of many of the products, activities and services that define the new economy.

"Banks are uniquely positioned between the real economy and capital markets. Holding the largest pool of assets - estimated at $139 trillion - they are critical to catalysing the transition to an inclusive green economy. This Manifesto is a clear and welcome call for the active participation of the banking sector to play their part in addressing the $5-7 trillion annual financing needed to achieve the global goals," said UNEP executive director, Achim Steiner.

Séverin Cabannes, deputy chief executive officer of Société Générale, said: "The Positive Impact Manifesto is a real milestone which will help us make decisive progress towards sustainable development goals and shows the willingness of the banks to engage in order to address the challenges of evolving towards a more inclusive and greener economy."

The Manifesto invites banks and other financial sector players to think more holistically about their role in the economy, society and the broader environment, and proposes a 'roadmap' to establishing a new, impact-based and market-driven paradigm - positive impact finance.

It defines positive impact finance as 'that which verifiably produces a positive impact on the economy, society or the environment once any potential negative impacts have been duly identified and mitigated'.

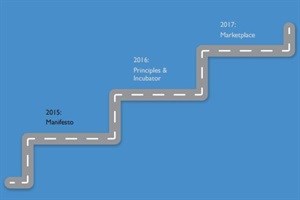

Over the next couple of years the UNEP FI's Positive Impact Working Group will be working with peers, clients, and other stakeholders to deliver a set of Positive Impact Principles that will guide providers of financial services in their efforts to increase their positive impact on the economy, society and the broader environment.

The group also aims to establish a Positive Impact Incubator where new business models and financing approaches can be tested by financiers and corporates to improve the bankability of positive impact transactions. Ultimately, the group expects a series of pilot projects to deliver a vibrant market place where needs, solutions and financing can be matched effectively.