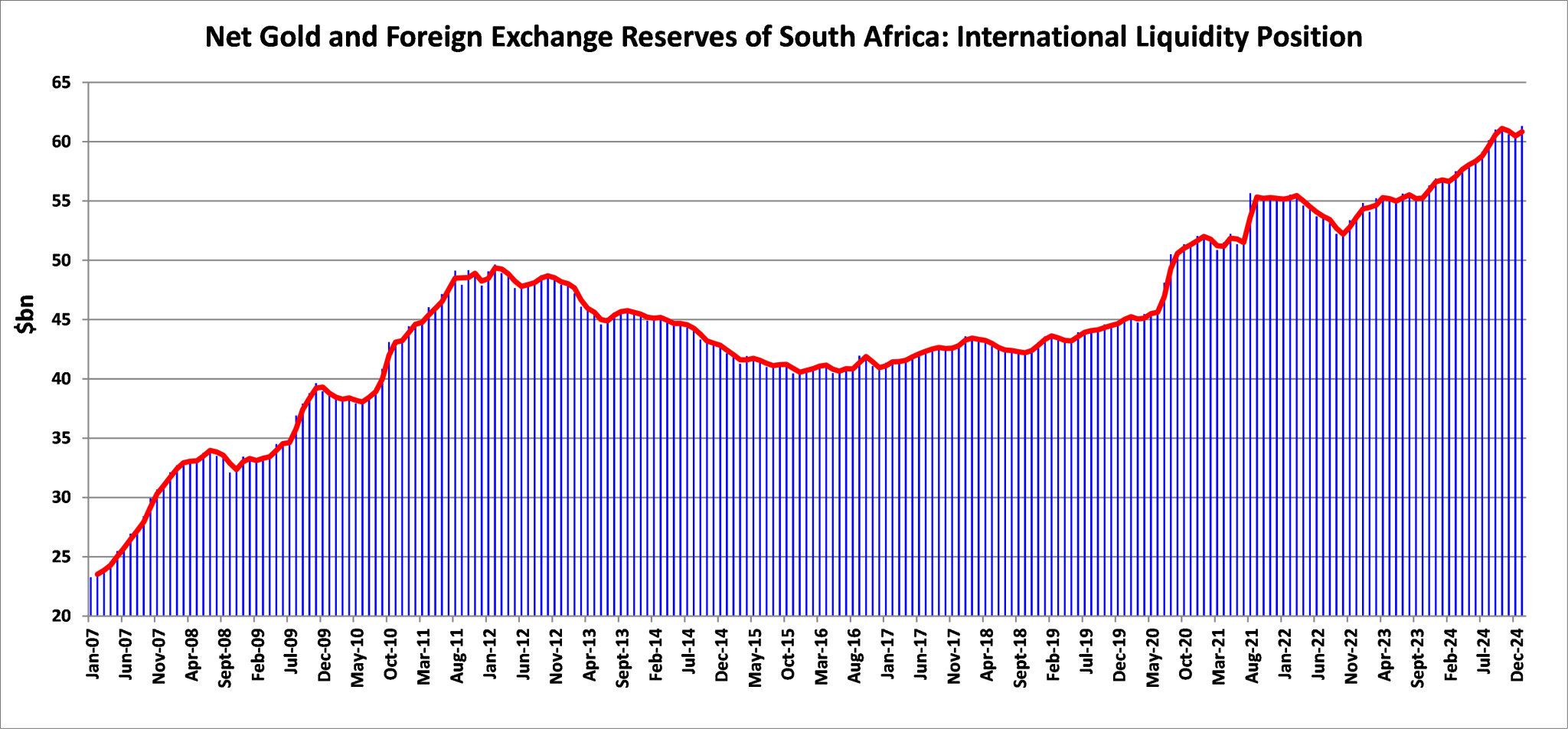

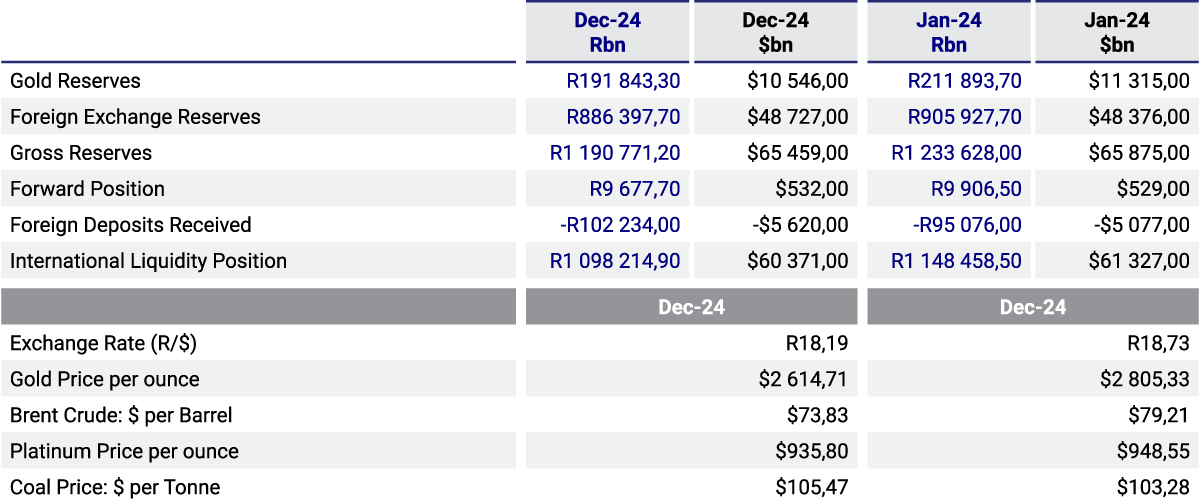

The African International Liquidity Position, as measured by Net Gold and Foreign Exchange Reserves, showed increases in both U.S. dollar and Rand terms for January 2025. Despite the Rand depreciating by approximately 50 cents against the dollar, the value of reserves in both currencies increased during the month. Additionally, gold reserves rose in Rand and dollar terms, largely due to a 7.3% monthly increase in gold prices, with the dollar price continuing to be 37.6% higher than the same period in 2024.

Foreign exchange reserves also saw a notable increase from December 2024 to January 2025, despite the Rand’s slight depreciation following former President Trump’s re-election. Key commodities for South Africa, such as gold, oil, platinum, and coal, offer valuable insights into the mining sector, fuel prices, and potential inflation. Monitoring these trends is vital, as inflation expectations will influence the South African Reserve Bank’s Monetary Policy Committee (MPC) in its upcoming interest rate decisions after the January 2025 rate reduction.

In January 2025, gold and oil prices notably increased, while coal prices remained stable, and platinum saw a rise of over $10 per ounce. A stable Rand and consistent oil prices support positive inflation expectations and future interest rate decisions following the January MPC meeting. However, the situation could shift rapidly due to ongoing international developments and diplomatic tensions between South Africa and the U.S.

It is likely that the Rand will remain soft and volatile in the coming weeks, particularly with Trump returning to the White House and ongoing disagreements between Pretoria and Washington. His protectionist economic policies and potential foreign policy changes may further impact the Rand’s performance in the near term.