Insight Survey’s latest SA Private Healthcare Industry Landscape Report 2020, carefully unfolds the global and local private healthcare markets, based on the latest information and research. It examines South Africa’s burden of disease, latest SA trends and technology, private healthcare practitioner stats, hospital and clinic stats, medical aid and pharmaceutical sector trends, to present an objective insight into the South African Private Healthcare Industry environment and its future.

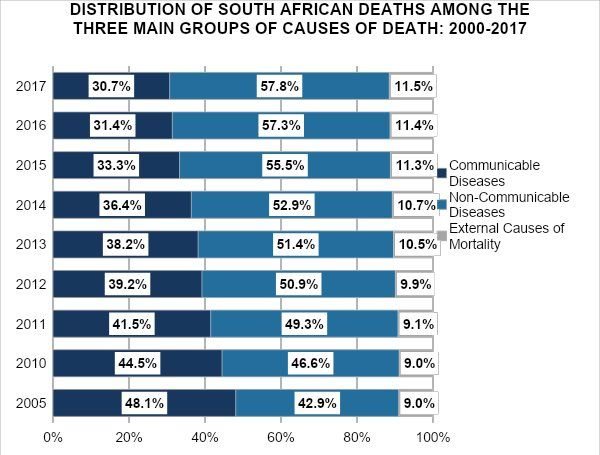

Although Covid-19 cases and deaths currently dominate the news, mortality rates have continued to decline annually in South Africa in recent years, with the number of registered deaths in 2017 reaching 446 544, a decrease of 5.1% when compared to 2016. Furthermore, similarly to the global trend, deaths due to Non-Communicable Diseases (NCDs) i.e. chronic diseases in South Africa continue to grow, with approximately 57.8% of deaths in 2017 being due to NCDs.

Source: Stats SA Graphics by Insight Survey click to enlargeDespite these reductions in terms of the number of local registered deaths, the ongoing Covid-19 pandemic is likely to raise the numbers of overall registered deaths, as well as deaths due to communicable diseases in 2020. This presents both a challenge, in terms of capacity and demand, and an opportunity, in terms of demonstrating its effectiveness, to the local private healthcare industry. This is particularly relevant, as the spectre of the implementation of National Health Insurance (NHI) looms large over the industry, making it important for the sector to emphasise its value.

Key to the private healthcare sector’s response to Covid-19, has been the development and deployment of innovative mobile technologies. These technologies enable an enhanced standard of care to patients, that can be delivered in an efficient, safe and cost-effective manner. These technologies also contribute to healthcare practitioner wellness, whilst reducing costs to providers, such as medical aids and hospital groups, already experiencing financial strain.

As an example of the implementation of technology by the private healthcare sector in South Africa, artificial intelligence (AI) is being employed in the form of predictive data analytics, electronic health records and medication dispensing, amongst others. For example, Phulukisa Healthcare Solutions has developed a mobile clinic utilising an AI-powered cloud backpack, making it possible for specialists to test for deadly diseases in rural areas. Additionally, Radify is making use of AI to reduce the time required for the diagnosis of pneumonia in Covid-19 patients, in their Envisionit Deep AI diagnostics platform.

Moreover, local innovations designed to enable remote healthcare provision include a remote medication administration device, developed by researchers at the University of Cape Town and the Osmania University in India. This device remotely notifies healthcare professionals when a patient requires medication, allowing for the remote administration of the medication accordingly. Furthermore, in terms of monitoring, researchers at the University of Johannesburg (UJ), have developed a smart toolkit called e-mutakalo, which can monitor a patient’s health status and alert healthcare professionals when necessary.

The utilisation of mobile technology in the private healthcare sector is likely to continue to grow, as the industry adapts to the challenges posed by Covid-19, whilst also positioning private healthcare as a valuable contributor to South Africa’s overall healthcare environment.

The SA Private Healthcare Industry Landscape Report 2020 (158 pages) provides a dynamic synthesis of the global and SA private healthcare industry, from a uniquely holistic perspective, with detailed insights on: Global and SA burden of disease; latest global and SA healthcare trends and innovations; SA private healthcare practitioner statistics; SA private hospital and clinic stats, SA private hospital groups, SA medical aid sector and the SA pharmaceutical services sector.

Some key questions the report will help you to answer:

- What are the major communicable and non-communicable causes of death, both globally and within South Africa?

- What are the latest 2020 private healthcare practitioner, hospital and clinics stats?

- What are the characteristics of the South African medical aid landscape, including trends and details of medical aid beneficiaries, medical aid schemes, administrators, major company profiles, and benefits paid by medical aids?

- What are the characteristics of the South African hospitals and clinics landscape, including private healthcare facility statistics, and private healthcare hospital groups?

- What is the 2020 SWOT (strengths, weaknesses, opportunities and threats) for the SA pharmaceutical services sector?

Please note that the 158-page report is available for purchase for R30,000 (excluding VAT). Alternatively, individual sections can be purchased for R12,500 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (021) 045-0202 or (010) 140- 5756.

For a full brochure please go to South African Private Healthcare Industry Report 2020

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 13 years of heritage, focusing on business-to-business (B2B) and industry research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B and industry research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke competitive business intelligence research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.