While the benefits of digital are not in question, the mining industry in general, and South Africa mining in particular, lags behind other industries in realising the benefits that digital will bring. This article outlines the sources of value, explores the roadblocks that stand in the way of digital transformation, and provides approaches to overcome those roadblocks. It concludes with a call for action – what regulators and companies need to put in place to seize the opportunity.

Looking back a decade, the mining industry at large was sceptical as to whether digital can bring sizeable value to their operations. As of today, the nature of the digital discussion has fundamentally changed – it is no longer about whether there is value, but rather about how to capitalise on the value promise, and overcome the many roadblocks mining companies face during their digital journey.

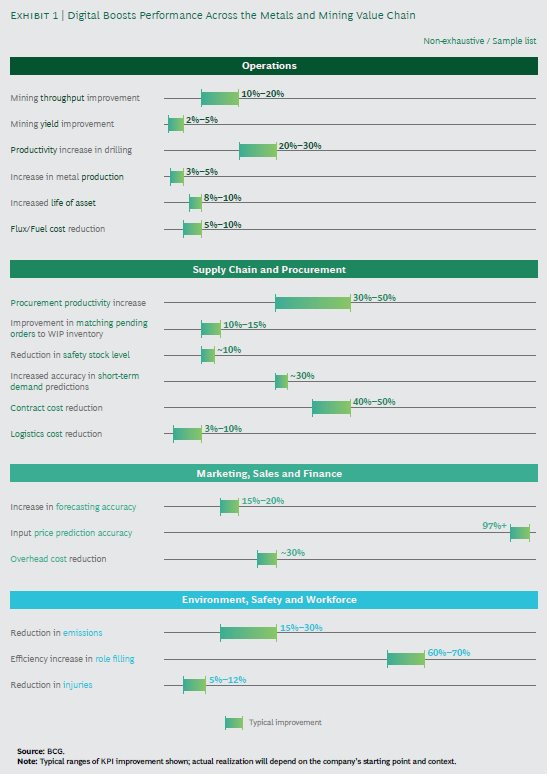

As Boston Consulting Group's (BCG's)s Digital Acceleration Index (DAI) reveals, the bottomline gains of those companies that ‘get it right’ are pronounced – and not limited to ‘just’ operational or financial gains, but also offering benefits for employees such as improved safety and environmental advantages such as lower emissions. As shown in figure 1, BCG’s DAI research highlights that “digital” companies achieve mining throughput improvements of 10% to 20% and emission reductions of 15% to 30%.

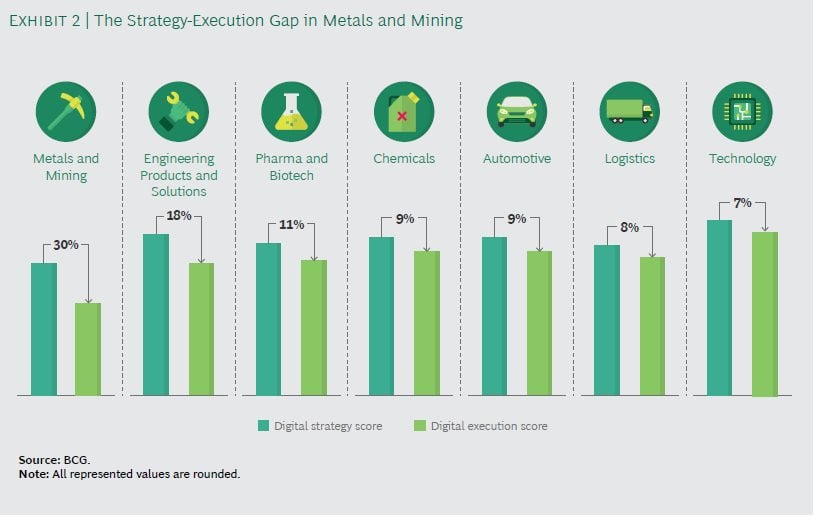

At the same time, the DAI results also reveal an overall digital maturity lag - the metals and mining industry has fallen behind other sectors such as automotive and chemicals. As shown in figure 2, what is even more alarming is the substantial gap between the digital strategy and the digital execution score of mining companies – in simple terms, miners have reasonable digital ambitions, but fall short executing on those ambitions.

So, while a select few mining players are ahead of the wave, the broader base of mining companies is struggling to turn digital ambition into action. Comparing those who thrive with those who struggle, we found five distinguishing qualities that sets the champions apart from the contenders. Those insights provide an opportunity for companies to quickly learn from experiences of their peers and drive adoption more quickly – provided there is a will, and a supportive and enabling environment. Let’s have a look at the five overarching recommendations to achieve successful digital transformation.

Most metals and mining companies have ambitious digital strategies in place, but the gap between strategy and execution is significant. Our research found three reasons to explain (and, address) this gap.

i. Lack of customised solutionsii. Use of traditional waterfall models instead of agile methods to deploy digital products

iii. An inadequate focus on a solution’s sustainability

The value of data in digitally advanced industries such as banking and retail is obvious. But for many metals and mining companies, investments in data capture technologies are still viewed as little more than an additional cost. According to the DAI survey, only about 10% of the industry views data as a corporate asset. As a result, mining companies need to shift their perception of data, and realise it as an intangible, but highly important source of business value.

Digital leaders understand the power of leveraging both internal and external ecosystems, and the benefits of building interconnected solutions on the same digital foundation:

Most metals and mining companies have adopted traditional operational improvement tools, including overall equipment effectiveness, Six Sigma, and lean business principles. Now leaders need to add digital to this toolbox.

Of the organisations we surveyed, 30% had no digital upskilling plan at all, while another 45% had only recently begun training initiatives. In addition to changing requirement of ‘hard’ skills (such as data analytics capabilities), new ways of working will be required to unleash the full potential of digital. For example, remoting operation of equipment will become the norm – imagine a truck driver operating the equipment from the comfort of an office in Johannesburg hundreds of kilometres away from the mine. Shaping this culture requires time and can be arduous, but the potential payoff for the company and the individual employees is tremendous.

Metals and mining companies have traditionally focused most of their digital efforts on improving operations. As a result, digital maturity scores—even among digital leaders—are much lower in areas such as sales and marketing, procurement, supply chain, finance and human resources. By neglecting those areas of opportunities, mining companies are leaving substantial value on the table.

While South Africa faces similar issues to those faced by global mining companies, the country’s specific context provides its own challenges – but also opportunities – on the digital transformation journey. The relevance of the mining industry for South Africa’s GDP, foreign exchange earnings, and employment deems a successful digital transformation a necessity.

To fully leverage its strengths and address the prevailing issues, the country needs to embrace digital change – it will enhance productivity and deem a broad set of deposits economically feasible to exploit. Growing mining output will secure employment, benefit host communities and the country as a whole.