The number of digital payment solutions on offer has risen sharply since the start of the global pandemic. Consumers are no longer confined to only paying with cash or their bank cards but have a plethora of options to choose from, including Google Pay and Apple Pay.

To avoid losing sales to their competitors, businesses need to be able to accept the increasing number of payment methods emerging onto the scene.

It’s why Cape Town-based fintech, SnapScan, partnered with Standard Bank to develop the SnapStore Pro, an all-in-one card machine that can process multiple payment types.

SnapScan is no stranger to developing innovative payment tools. In 2013 the local payment service provider revolutionised mobile payments with their QR code payment technology. Now, they’ve combined their scan-to-pay offering with card and gadget pay acceptance to make it as simple as possible for small businesses to accept all their customers' favourite payment methods from one device: the SnapStore Pro.

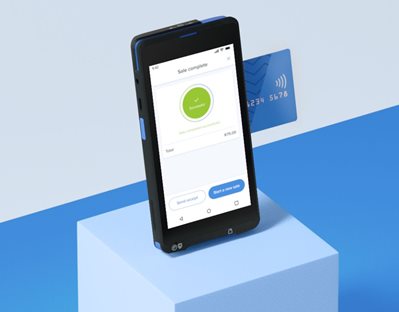

The SnapStore Pro allows customers to tap, insert, or swipe their bank cards, scan the on-screen SnapCode, or use Apple Pay, Samsung Pay or Garmin Pay. Businesses can also use the SnapStore Pro to ring up and record their cash payments.

By having access to all these payment methods on one device, businesses can now accept all their customers preferred payment methods and decrease their risk of losing a sale.

The SnapStore Pro also enables businesses to service more customers in less time. Businesses will spend less time switching between payment tools and more time focusing on what matters most: their customers.

The SnapStore Pro is a standalone card machine that functions like a smartphone. The snappy card machine is Wi-Fi-enabled and comes with a SIM card preloaded with free data.

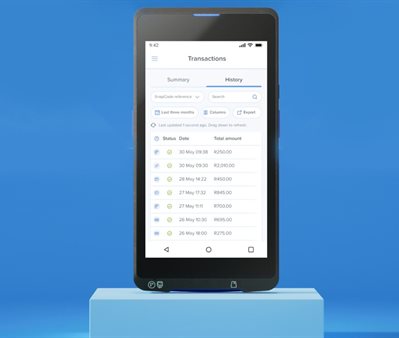

Besides accepting face-to-face sales, businesses can also manage their transactions with the SnapStore Pro card machine. Businesses can quickly view their transaction history to track, identify and reconcile their transactions from the same device they use to accept payments.

In addition to saving time by processing payments on one device, businesses can also save on transaction fees by paying a lower rate for all their transactions. SnapScan’s rates are dynamic; the more businesses transact, the less they pay. Their transaction fees will be based on the previous month's turnover, starting at 2.95% (excl. VAT) and decreasing to 2.55% (excl. VAT). There are no additional monthly or settlement fees.

SnapScan also settles every business day, which means businesses using the SnapStore Pro card machine will have quicker access to their hard-earned cash. Businesses that bank with Standard Bank will receive a next-business-day settlement, while other businesses will receive their settlement within 2–3 business days.

Ready to save time and money with the SnapStore Pro? Sign up for a SnapScan merchant account here, and order your SnapStore Pro for R999 today.