“Investing into private brands not only benefits the business but enables us to support local suppliers where possible and provide the most competitive pricing for our customers,” says Clyde Hill, group private brand vice president at Massmart. “Our goal is to make essential items accessible to all our customers without compromising on quality, whether they are purchasing to resell, or doing a monthly pantry shop for their homes.”

McKinsey’s Global Consumer Sentiment Survey found that 61% of South African consumers (across income levels) are cutting back on spending, with 70% of respondents paying more attention to the price of products. Just over a third of respondents reported substituting branded products with more affordable alternatives – such as private brands; an increase of 10 percentage points since the start of the Covid-19 pandemic.

Traditionally, popular private brand products included staples and household cleaning supplies but research conducted from Nielsen HQ shows private label products now represent 24% of total basket value in South Africa. Competitive pricing, coupled with a quality offering has driven the acceptability of private brand products in many new categories, including those that have historically been dominated by national brands.

Massmart owns 86 private brands across the categories of food, general merchandise and home improvement; some of which are national brand leaders in their own right, such as Camp Master, Trojan Health and Garden Master. With inflation eroding consumer buying power, private brands in the food category have experienced most of the increased demand.

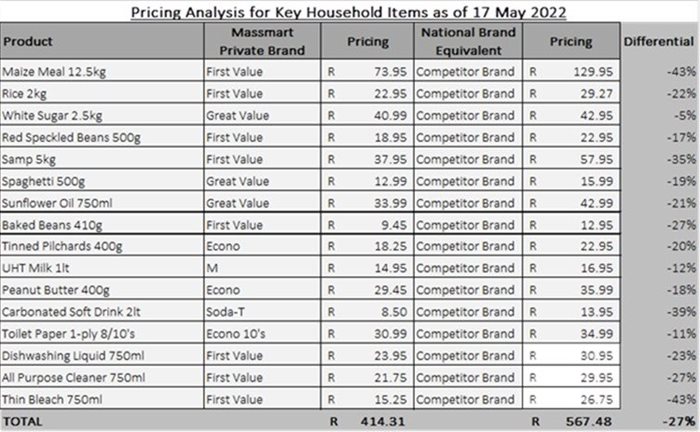

Massmart recently conducted a pricing comparison on 16 household essential items using its private brands First Value, Great Value, Econo and M as like-for-like substitutes for popular branded products. The comparison yielded interesting results with savings as high as 20-40% on essential products including rice, maize meal, milk and toilet paper.

In addition to "striving to offer consumers the best possible quality at the lowest possible price", the group says it has also increased its focus on elements such as the packaging and marketing of its private brands.

“With approximately 46% of South Africans receiving some form of social grant, there has never been a more important time to offer cost-saving alternatives to our consumer,” Hill concluded.